< RESOURCES / >

A Practical Guide to Proof of Concepts in Fintech

A proof of concepts (PoC) isn't a massive project. Think of it as a small, focused experiment designed to answer one simple question: is this core idea technically feasible? Its sole job is to prove or disprove a critical assumption before you commit significant time and budget to a full-blown product.

This focused validation is your first line of defense against risk, giving you hard evidence that a critical function can work as envisioned. It connects a technical experiment directly to a business outcome by preventing wasted investment and accelerating time-to-market for viable ideas.

Why Proof of Concepts Are Essential in Fintech

Before committing capital to a new fintech product, you must know if the core technology is sound. That’s what a PoC is for. It’s a powerful risk-mitigation tool that lets you test a critical integration, validate a tech stack, or get stakeholders on board with real data, not just a presentation.

In the fintech and cloud product space—where security, complex integrations, and regulatory compliance are non-negotiable—a PoC is a business imperative. It provides a safe, low-cost environment to test your riskiest assumptions before the stakes get high, directly impacting cost and reducing project risk.

Clarifying PoC vs. Prototypes and MVPs

These terms are often used interchangeably, but confusing them leads to wasted time and money. Each serves a distinct business purpose.

- Proof of Concepts (PoC): Focuses entirely on technical feasibility. It’s typically internal-facing, unpolished, and built to be discarded. The only output that matters is a clear "yes" or "no" to a specific technical question, de-risking the technology choice.

- Prototype: Focuses on the user experience and workflow. It's an interactive mock-up that demonstrates how the product will look and feel. The goal is to gather early feedback on usability before writing functional code, reducing market risk.

- Minimum Viable Product (MVP): This is the first market-ready version of your product. It has just enough features to be genuinely useful to early customers, allowing you to test market demand and gather real-world data to guide future development and generate initial revenue.

Understanding the unique purpose, audience, and outcome for each validation method is crucial. Getting it wrong leads to scope creep and muddled results.

Using the right tool for the job ensures you're answering the most important question at the right time, without wasting resources.

A PoC that proves an idea is not feasible is a massive success. It just saved the company a fortune in wasted development costs. Embracing this "successful failure" is one of the smartest things a business can do.

By isolating your riskiest technical assumption and tackling it head-on, a well-run PoC provides the confidence to move forward. This directly impacts the bottom line by slashing financial risk and ensuring your development team builds on a solid, validated foundation from day one.

Defining a Laser-Focused PoC Scope

The single biggest killer of any proof of concepts is a vague, undefined scope. The trap is starting to test a bit of everything and ending up with inconclusive results, a blown budget, and wasted time.

A PoC isn’t a mini-product; it’s a surgical strike. The goal is to isolate the single most critical technical assumption and validate it with precision. Getting this right is the difference between a valuable learning exercise and a failed project.

Your first job is to dissect your product vision. Identify all the technical components. Which one is the linchpin? Which integration, algorithm, or technology would cause the entire project to fail if it didn't work?

That is the heart of your PoC.

Identifying Your Core Hypothesis

Frame that core risk as a specific, testable question. "Test our payment flow" is a useless goal because it's too broad.

Let’s say you’re building a new fintech lending app. The real risk probably isn’t the signup form. It's the real-time integration with a credit-scoring API and whether it can perform under load.

Here's the difference between a weak and a strong hypothesis:

- Weak Hypothesis: "Can we connect to a payment gateway?"

- Strong Hypothesis: "Can our architecture receive, process, and confirm a payment transaction via the Stripe API in under 500ms while handling 100 concurrent sandbox requests?"

The second one is a measurable experiment. It forces you to define success before writing code and is your best defense against scope creep.

The objective is to generate a clear signal, not noise. A laser-focused scope ensures the results are binary and actionable: either the core hypothesis was validated, or it was not. There should be no room for ambiguity.

Setting Clear Boundaries and Success Criteria

With your hypothesis locked in, set the non-negotiables. These guardrails keep the project from spiraling out of control. Your PoC scope document must be crystal clear on these points.

Here are the constraints you must define upfront:

- Fixed Timeline: A PoC must be fast—typically two to four weeks. A hard deadline forces ruthless prioritization and maintains momentum.

- Strict Budget: Lock in a firm budget covering developer time, third-party service costs, and any other expenses.

- Specific Success Metrics: Quantify the pass/fail criteria. This could be transaction speed, data accuracy, or API response time.

- "Out of Scope" List: Be explicit about what you are not building. This is just as important. A polished UI, full user authentication, or extensive error handling should all be on the "not now" list.

Once you have that focus, tools like wireframes can help clarify the user experience. You can see how powerful visual planning is in this guide on Wireframes: The Path From Concept To Completion. This rigorous scoping isn't bureaucracy; it's how you ensure your PoC delivers a clear answer that de-risks your investment and accelerates time-to-market.

Designing a Lean and Effective Architecture

A common trap for a proof of concept is over-engineering the architecture. Remember, this isn’t the final production build. The point is speed and validation, not building for infinite scale from day one.

Your PoC needs a ‘minimal viable architecture’—just enough of a framework to prove your core idea without getting bogged down in complexity or creating technical debt.

This requires ruthless tech choices. Instead of building a custom authentication system, use a pre-built service or hardcoded credentials for the demo. Lean on managed cloud services like AWS Lambda or Azure Functions to bypass server setup. The less time spent on boilerplate, the more you have for the real technical challenge.

Practical API and Integration Patterns

For fintech PoCs, the most critical moment is often integrating with third-party services. Proving the plumbing works early is a massive win. The key is to leverage sandbox environments.

If you’re testing a payment flow, you don't need real money. Connect your PoC directly to the sandbox APIs from providers like Stripe or TrueLayer. These test environments mimic real-world functionality, letting you validate your entire integration logic without the risk or compliance overhead of touching live financial data.

This approach provides undeniable proof that your system can communicate with the critical external services it depends on, which directly validates a key business dependency.

A PoC’s architecture doesn't need to be perfect. It just needs to be good enough to give you a clear "yes" or "no" on your core technical question. Every component should serve that one purpose.

The Importance of Mocking Dependencies

Even with sandboxes, you’ll encounter issues. A partner’s test environment might be slow, down, or have rate limits that kill your momentum. This is where mocking becomes essential. By creating a fake service that returns the same kind of responses as an external API, you can completely isolate your own logic.

Here’s why that matters for business outcomes:

- Isolate Your Code: Mocking lets you test your application's behavior in a controlled environment. You can be confident your code works without blaming an external service for failures.

- Accelerate Development: Your developers aren't stuck waiting for a third-party API to come back online. Maintaining momentum within a tight PoC timeline is critical for controlling costs.

- Simulate Edge Cases: It's hard to trigger specific errors in a live sandbox. With a mock, you can easily simulate various responses to see if your system handles them gracefully, proving its resilience.

Once you've built your isolated components and proven your integrations, a focused testing strategy is needed to ensure everything holds together. You can learn more about comprehensive QA and testing methodologies that support the PoC process.

By building just enough to prove your core hypothesis, you get fast, reliable answers about what's technically possible, which reduces project risk and informs your go-to-market strategy.

Integrating Security and Compliance from Day One

In fintech and cloud development, adding security and compliance at the end is a common and costly mistake. For your proof of concept, ignoring these factors can invalidate your work, forcing expensive rewrites or a complete restart.

Nobody expects your PoC to be fully audit-ready. The goal is to prove that a secure and compliant solution is achievable with your chosen architecture. It's about building in that awareness from day one to confirm your technical path can meet industry demands, thus de-risking future compliance efforts.

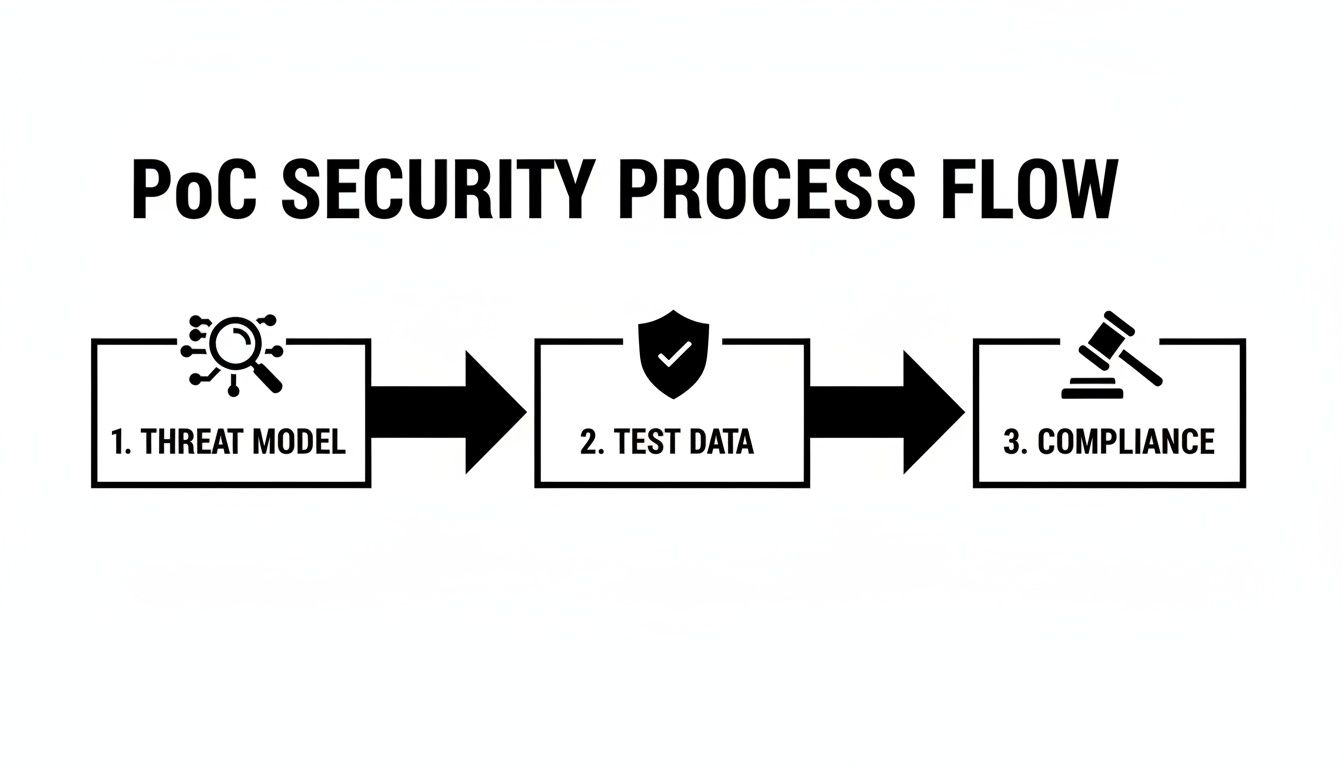

Lightweight Threat Modeling for Your PoC

Start with a quick, lightweight threat modeling session. Focus only on the small slice you're building for the PoC and ask direct questions.

- Data Handling: Where is our test data stored and how is it accessed? Even if it's anonymized, are you demonstrating sound principles for secure data handling?

- API Interactions: What are the obvious vulnerabilities at the connection point with a third-party API?

- Access Control: Who can access the PoC environment? You might use hardcoded credentials now, but does the logic show that it can be properly secured later?

This focused approach helps spot major security red flags early without slowing down the validation process. You can learn more about how continuous validation uncovers vulnerabilities in our guide to penetration testing as a service.

Proving a Compliant Path Is Feasible

Your PoC must also acknowledge the regulatory landscape you'll eventually face. For a fintech product, this means considering frameworks like PSD2 or GDPR from the beginning.

For example, if your PoC touches user data, you should be able to show how your design could support data subject rights, even if the full feature isn't built yet.

The question your PoC needs to answer isn't "Are we compliant today?" It's "Does this architecture have any fundamental flaws that would stop us from ever becoming compliant?" Answering that question saves time and reduces risk down the line.

This checkpoint-driven approach is gaining traction. In Hungary, for instance, national PoC funding calls recently allocated HUF 3.45 billion to projects with mandatory milestone checks, proving the value of built-in accountability. You can find more details on this structured funding on nkfih.gov.hu.

To ensure you're on solid ground, a resource like the Enterprise AI Security 2025 Guide for Audit-Proof AI Systems can help you bake compliance and security in from the start. This proactive mindset turns your PoC from a simple tech demo into a powerful tool for de-risking your product and business.

Assembling Your PoC Team and Sprint Plan

Even the most perfectly scoped proof of concepts will fail without the right people and a tight timeline. A PoC thrives on a small, focused, and empowered team that can move fast without getting bogged down in bureaucracy.

The ideal setup is a lean trio—a small task force built for speed. You need just enough expertise to validate the core hypothesis, and nothing more.

If you have in-house skill gaps, like cloud security or specific fintech integration experience, flexible team augmentation can fill those critical holes without disrupting your schedule or budget.

Your Core PoC Team Composition

To maintain momentum, your team should be built around a few key roles. Each person brings a critical perspective needed to reach a clear decision quickly.

- The Senior Engineer: Your hands-on builder. They need the technical skill to spin up environments, write clean-enough code, and troubleshoot integrations efficiently.

- The Product Stakeholder: This person represents the business and keeps the PoC focused on its original goal. They are the final decision-maker, responsible for clarifying requirements and giving the ultimate go/no-go.

- The Specialist (Cloud/Security): For any fintech PoC, this role is non-negotiable. They ensure the proposed architecture doesn’t have glaring security holes or compliance dead ends, establishing essential guardrails from the start.

This isn’t just about building something that works; it’s about building something viable.

Running multiple small, focused validations is a powerful de-risking strategy. This portfolio approach is mirrored in large-scale innovation funding. For instance, Hungarian NRDI guidance once required a portfolio of 20–40 PoC investments per technology transfer company. You can see how this portfolio approach helps to accelerate innovation on nkfih.gov.hu.

A Sample Two-Week Sprint Plan

A tight, two-week sprint creates urgency and focus. It forces the team to be ruthless with prioritization and is the best defense against scope creep. Here’s a practical timeline to keep everyone on track.

Week 1: Laying the Foundation

- Days 1-2: Set up the dev environment, configure cloud services, and secure access to third-party sandbox APIs (e.g., Stripe, TrueLayer).

- Days 3-5: Build basic data models and push for the first successful end-to-end API call to validate the core integration.

Week 2: Adding Logic and Prepping the Demo

- Days 6-8: Implement the core business logic needed to test the hypothesis, including basic error handling.

- Days 9-10: Refine the workflow, assemble the final demo, and document the key findings, outcomes, and final recommendation.

This structured plan transforms your PoC into a disciplined project with a clear path to a go/no-go decision, connecting technical validation directly to business strategy.

Analyzing Results and Making the Go/No-Go Decision

With the sprints complete, it’s time to move from a technical demo to a business decision. Your job is to present a compelling case backed by clear evidence.

It all comes back to the success criteria defined during scoping. Did you hit the target API response time? Did the integration hold up under the defined load? A direct comparison of your goals versus the actual results creates an objective foundation for your recommendation.

Turning Technical Results into Business Outcomes

The final report must be honest about what you learned—both wins and failures. Sometimes, the most valuable outcome a PoC can deliver is proving an idea is a technical dead-end or too expensive to build. That’s not a failure; it’s a strategic win that saves the company millions in wasted effort.

From here, you can develop a high-level estimate for a full production build, including timelines, team size, and budget. This connects the technical exercise to a tangible strategic plan. The final presentation must clearly articulate what your findings mean and conclude with a confident recommendation.

A technically successful PoC is only half the story. If you can't see a clear path for customers to use it and for the business to integrate it operationally, even the most brilliant idea will fail to deliver value.

For example, Hungary has poured billions into PoC funding, yet a European Commission report noted struggles with innovation procurement, implementing only 16.04% of recommended policies. This is a reminder that even with funding, external roadblocks can kill a project. You can review the details in the 2024 policy benchmark report on ec.europa.eu.

Your final recommendation should lead to one of three clear paths:

- Go: The hypothesis was validated, the technology works, and the business case is sound. Proceed with the project.

- Pivot: We learned a lot, but the initial approach was flawed. We need to adjust the technology or rethink the scope.

- Kill: The concept is not viable. It’s not technically feasible, it’s too expensive, or the risks are too high. Terminate the project.

This process transforms a technical experiment into a powerful strategic tool for the business.

FAQ: Your Proof of Concepts Questions Answered

We've guided dozens of teams through the PoC process. Here are answers to the most common questions we encounter.

How Long Should a Proof of Concept Take?

Keep it tight. The sweet spot is two to four weeks.

Any shorter, and you likely won't get meaningful data. Any longer, and you're drifting into prototype territory. This deadline isn't arbitrary—it forces a ruthless focus on the one critical question you must answer, preventing scope creep and controlling costs.

What’s the Single Biggest Mistake Teams Make?

Without a doubt, it’s scope creep. It often starts with a seemingly innocent request: "Can we just add one more small feature?"

This is the fastest way to derail the entire exercise. A PoC is a surgical tool designed to answer a specific question. Adding extras dilutes the results, drains resources, and makes it impossible to get a clear go/no-go signal. Sticking to the initial plan is essential for a successful outcome.

A PoC that proves a core technical assumption is wrong or not feasible is a major success. It saves the company significant time, money, and resources that would have been wasted on a full-scale project destined to fail.

Can a PoC "Fail" and Still Be a Win?

Absolutely. A PoC that delivers a clear "no" is one of the most valuable business outcomes you can achieve.

Proving an idea is technically impossible, too expensive, or non-compliant before committing a large budget is a massive strategic victory. This "successful failure" provides the hard data needed to kill a flawed project with confidence and pivot resources to more viable opportunities.

Ready to de-risk your next big idea with a focused, data-driven approach? Our expert engineers can help you plan and execute a proof of concept that delivers the clarity you need to move forward with confidence.

< MORE RESOURCES / >

Fintech

A Guide to Epic Store Szeged and the Local Tech Scene

Fintech

A Guide to Designing a Nordic Light Office for Technical Teams

Fintech

A Tech Employer's Guide to Hungary's Social Security System

Fintech

How to Choose an IT Company That Drives Business Outcomes

Fintech

A Consultant's Guide to Part-Time Jobs in Budapest

Fintech

A Consultant's Guide to Peppol Integration for E-Invoicing

Fintech

A Tech Leader's Guide to Nearshore Development

Fintech

PSD2 Integration for CTOs: Real-World Challenges and Architecture Insights

Team augmentation

Hiring vs. Outsourcing: Finding the Right Balance with Team Augmentation

Fintech